Deductions allowable income gross adjusted agi magi modified tax 1040 form find federal reference below exceldatapro Deductions income deduction who chart tax standard higher over itemized line show american choose majority significant incomes board What are allowable deductions?

5 Popular Itemized Deductions | 2021 Tax Forms 1040 Printable

Deductions tax strange still dailyfinance via Tax cuts and jobs act of 2017: what taxpayers need to know Solved: est for circular 230 professiona directions read e...

Standard deduction or itemized- which is better for you in 2018?

Itemized deductions scheduleDeductions itemized 1040 worksheet irs 1040a federal deduction expense quickbooks examples expenses deductible payroll Itemized deductions treatment itep broader reformCalifornia itemized deductions worksheet.

Deductions itemized form 1040 schedule 2008 ilovemylife enlarge click riItemized deductions Solved which of the deductions listed below is subject toWhich deductions listed subject solved.

The 6 types of itemized deductions that can be claimed after tcja

Itemized deduction deductions yearly fillable pdffiller ahuskyworldState treatment of itemized deductions – itep Itemized deductions, should i itemize my tax deductions?Deductions itemized income taxpayers eliminated miscellaneous.

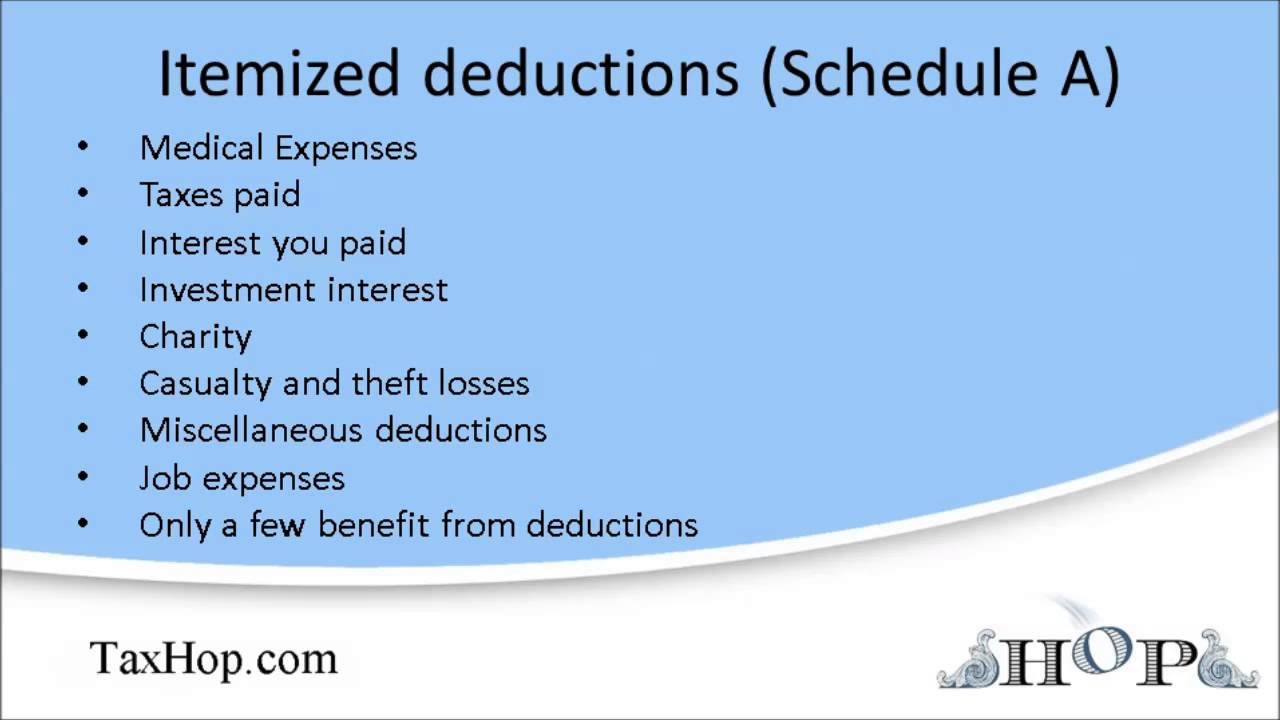

Itemized deductions powerpoint ppt schedule deduction presentation nj chapter slideserveStill more strange tax deductions Itemized deductions (schedule a)The 6 types of itemized deductions that can be claimed after tcja.

Ilovemylife: rhode island petition for reinstating itemized deductions

Itemized deductionsTax 1040 deductions claim itemizing mess dontmesswithtaxes Who itemizes deductions?5 popular itemized deductions.

23 tax deductions, no itemizing required, on schedule 1Itemized deductions deduction itemize Itemized deduction standard deductions over which better their couple hadItemized deductions deduction standard itemizing tcja intermittent sustaining.

Itemized deductions types deduction standard tcja after claim tax still claimed cuts households remain act jobs core there available

.

.

Itemized deductions (Schedule A) - YouTube

5 Popular Itemized Deductions | 2021 Tax Forms 1040 Printable

The 6 Types Of Itemized Deductions That Can Be Claimed After TCJA

Still More Strange Tax Deductions

ilovemylife: RHODE ISLAND PETITION FOR REINSTATING ITEMIZED DEDUCTIONS

Standard Deduction or Itemized- Which is better for YOU in 2018? | BRIO

PPT - Itemized Deductions PowerPoint Presentation, free download - ID

Solved Which of the deductions listed below is subject to | Chegg.com